A NonProfit's Guide to Solar Energy: Savings, Benefits, and Incentives

Nonprofits, from educational institutions to healthcare facilities, share a common challenge: balancing budget constraints with mission goals.

Solar energy can now redirect funds from high utility bills to core services.

In this blog, we’ll share the information you need to know about solar for nonprofits, including the cost-saving incentives that make it more affordable.

Cutting Costs: How Solar Benefits Non-Profits

Less Money on Energy, More Money for Your Cause

As long as your company is in business, you will use electricity. Bill after bill, month after month, more and more cash flies out the door with rising electricity rates. But solar energy can help you eliminate or reduce this monthly expense.

If you opt for solar ownership, you could generate free electricity for decades once you pay off the initial investment. The average solar energy system has a life of about 30 years, leaving plenty of time to capitalize on the ROI of solar.

With the new federal direct payment benefit, the upfront investment in solar will be easier in 2023 than in years past. However, if it’s still not practical for your organization, you have options through third-party ownership.

With Power Purchase Agreements (PPAs) and solar leases, you can reduce your electric rates and start saving on day one with little to no money invested upfront. More on this in the next section.

Net Energy: Net Good for the Environment

The more electricity you use, the larger your system and the greater your environmental impact. Solar energy doesn’t require anything to run except for the sun. As one of the most abundant and cleanest renewable energy sources, the sun will keep your business going so you can do good without harming the environment.

Get Noticed in the Community

Solar will save money, but there are additional benefits. It’ll get you noticed in your community. Almost anyone can get behind solar, which will help mobilize donors. A donation for a nonprofit can reduce overhead and make your organization solvent.

Whether your mission aligns with preserving natural resources or not, the less money you spend on energy, the more money you can put towards doing good.

Deciding Ownership: Weighing Solar Options for Nonprofits

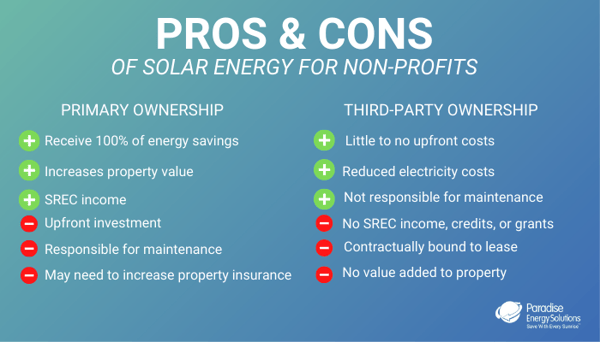

One of the biggest deterrents for nonprofits looking to go solar is financing. When it comes down to it, you have two major options: primary ownership and third-party ownership.

Primary Ownership

Primary ownership is when the nonprofit pays the complete upfront cost of the solar project, whether through out-of-pocket cash or loans. They are responsible for the system and any maintenance or repairs (though these should be minimal and often covered under warranties).

But all the financial benefits come with all the responsibility for the system. This includes federal tax credits, SRECs (if available in your state), and 100% of the electricity savings. In addition, you’ll be investing in a tangible asset that will increase the value of your property.

Previously, significant cost-saving incentives for going solar were unavailable to nonprofits because of tax status. The inflation reduction act passed in 2022 changes all that. We’ll explain how in the next section.

Third-Party Ownership

Before the Inflation Reduction Act, third-party ownership was a popular choice for many nonprofits because they couldn’t take advantage of tax-saving incentives. Solar leases and power purchase agreements (PPA) often offer no-money-down options, though some require an upfront investment.

Instead of owning the system yourself, an investor pays for the system. You’ll buy back the electricity generated by the system from the investor. Then, instead of paying your utility electric bill, you’ll be paying the investor/owner of the system.

This electricity is typically less expensive than utility electricity because the investor will take advantage of the tax incentives, and some offer a fixed-price plan that keeps you safe from rising electricity rates.

However, you agree to make these payments for the length of the contract, which could be up to 20-25 years. Unlike owning solar, the third-party owner will be responsible for the service and maintenance of the system, which can mean that they have full access to your roof or grounds during the lease. Also worth noting is that selling your property with a solar lease or PPA could be more difficult. You’ll have to find a credit-worthy buyer willing to assume the lease agreements.

Navigating Solar Incentives for Nonprofits: The Direct Pay Option

In the past, nonprofit organizations weren’t eligible for one of the most significant solar incentives because they didn’t have the tax liability required to qualify. However, 2022’s Inflation Reduction Act changed that. In addition to this 30% discount, other non-profit solar incentives and financing options are available.

The Inflation Reduction Act Changes The Landscape for Nonprofits To Invest In Solar Energy

Nonprofit systems are eligible for the federal direct pay option. The amount of this direct payment will vary depending on several factors.

Through 2024, all systems installed by tax-exempt entities will receive a 30% direct payment based on the cost of the system. After 2024, systems larger than 1 MW need to meet specific domestic manufacturing requirements to receive the full 30%. If they do not, they’ll only receive a portion, depending on the year:

- 2024: 90% of the 30% direct pay

- 2025: 85% of the 30% direct pay

- 2026: 0% of the 30% direct pay

Systems under 1 MW in size will receive the full 30% direct pay regardless of the equipment used.

There are also opportunities for bonus add-on savings. Nonprofits can also qualify for the extra 10% adders if the following conditions are met:

- 10% if the system is installed on a brownfield site or community with coal plant closures

- 10% if the system uses domestic content (the specific guidelines still need to be released)

- 10% if the system is installed in a low-income area or tribal land

The direct payment filing must be completed by the end of the next tax deadline, which for 501(c) non-profits is May of the following year. It could take up to one year or more to receive the direct payment.

State and Utility Rebates and Incentives

Another source of financing potentially available is Property Assessed Clean Energy (PACE) financing. PACE programs offer to finance renewable energy projects and energy efficiency upgrades.

Currently, there are 30 states plus Washington D.C. where PACE programs are active, and many more are developing their own programs. To find out what PACE financing is available in your area, visit PACENation’s website.

In addition to PACE financing, your state and/or utility may have other solar energy grants for non-profit organizations.

One state in the Mid-Atlantic stands out for its efforts in making solar installation possible for non-profits — New York. The Energize NY PACE program offers to finance for renewable energy and energy efficiency projects for both for-profit and non-profit businesses in New York. However, participation is based on the municipality.

Find out if your business qualifies for PACE here. New York also offers low-interest financing options for not-for-profits.

Check out t learn more about incentives available in your community, check out our solar incentive guide and the Database of State Incentives for Renewables and Efficiency.

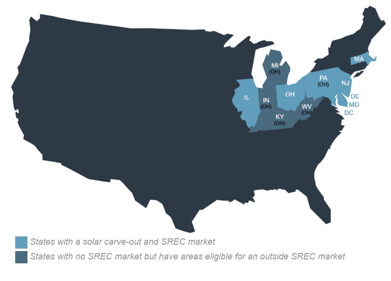

Solar Renewable Energy Credits (SRECs)

SRECs are certificates granted to solar system owners for every 1 MWh of electricity generated. You can sell these certificates at an auction or exchange platform at the market rate or have your solar installer do it for you.

Their rates are determined by many factors, including local legislation and the amount of solar energy your state produces. Read our Guide to SRECs to learn where SRECs are available and how much you could make.

Fundraising for Solar Projects: Engaging Your Community

While fundraising is never easy, raising funds for a solar power project comes with a great hook—you're asking for money now to ask for less later. Solar energy is an investment that will pay your organization back over the years with free electricity.

Whether it’s to slash your electricity costs, reduce your carbon footprint, or a little bit of both, installing solar panels for non-profit organizations can be a great way to get your company recognized and supercharge your mission.

Hear how other non-profits started saving money with solar energy:

Community Services for Autistic Adults & Children (CSAAC)

This blog was updated: March 2024