Your Guide To Solar Renewable Energy Credits (SRECs)

Table of Contents

One of the lesser-known benefits of owning a solar energy system is Solar Renewable Energy Credits (SRECs). SRECs may not be a household name, but they can drastically improve the financial returns of owning a solar system, which means putting more money in your pocket. They are a great addition to the electric savings and tax benefits you will gain with solar power.

If you’re new to the world of solar energy, you probably have a lot of questions about Solar Renewable Energy Credits (SRECs). What exactly are SRECs? How do they work? And perhaps most importantly, how much are they worth? Don’t worry; this blog post provides all the answers you need and more.

What Is A Solar Renewable Energy Credit (SREC)?

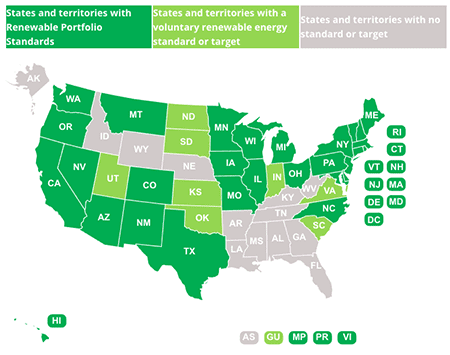

%20Work.png?width=450&name=How%20Solar%20Renewable%20Energy%20Credits%20(SREC)%20Work.png) Solar Renewable Energy Credits (SRECs) come from a program called the Renewable Portfolio Standard (RPS). RPS, which is enacted by 36 states in some form or another, is in place to develop the green portfolios of utility companies. This is how states meet their energy production goals from renewable energy sources - like New Jersey’s 50% by 2030. SRECs are the carve-out of the RPS that forces a percentage of the green energy production required to be fulfilled by solar energy.

Solar Renewable Energy Credits (SRECs) come from a program called the Renewable Portfolio Standard (RPS). RPS, which is enacted by 36 states in some form or another, is in place to develop the green portfolios of utility companies. This is how states meet their energy production goals from renewable energy sources - like New Jersey’s 50% by 2030. SRECs are the carve-out of the RPS that forces a percentage of the green energy production required to be fulfilled by solar energy.

The owner of a solar panel system can receive 1 SREC for every 1,000 kilowatt-hours (kWh) or 1 megawatt-hour (MWh) of solar electricity produced by their panels. That credit can then be registered and sold - generating additional revenue for the system owner.

Note: SRECs are only available for homeowners and businesses that own a solar system. Therefore, you will not be able to receive them if your system is leased or under a Power Purchase Agreement (PPA).

Check out this map from the National Conference of State Legislatures to see the states that have enacted Renewable Portfolio Standards regulations.

Check out this map from the National Conference of State Legislatures to see the states that have enacted Renewable Portfolio Standards regulations.What States Are SRECs Available?

Although the RPS legislation is enforced in 36 states, not all of them have a carve-out specifically for solar energy. Currently, five states plus Washington, D.C., have an SREC market. The SREC requirements in each of these states vary, and as a result, the value of the credits varies from state to state.

One specific regulation that varies by state is the location requirement of the solar system. A few states require that SRECs come from solar systems within their borders—New Jersey is one of those. In contrast, other states accept SRECs purchased from solar systems located outside of their state borders. This could potentially be a great benefit for solar panel owners in states without solar carve-outs, but on the flip side, these open-border policies will drive down the price of SRECs.

Here’s a list of the states that currently have an SREC market:

- Maryland

- Massachusetts (MA is no longer accepting new solar systems into their market)

- New Jersey

- Pennsylvania (The PA SREC border is now closed to all out-of-state systems)

- Ohio

- Virginia

- Washington, D.C. (closed to out-of-state systems)

How much are SRECs worth?

The value of SRECs is influenced by several factors, including the market's supply and demand dynamics. The supply of SRECs is determined by the number of qualified producers, which refers to homeowners and businesses that own solar panel systems. If there is a high number of qualified producers, the supply of SRECs will increase, potentially driving down prices. On the other hand, if the number of qualified producers is limited, the supply of SRECs may be scarce, leading to higher prices.

The demand for SRECs is determined by the number of credits that utility companies need to purchase in order to meet their renewable energy production goals. Each state sets a specific target for the percentage of green energy that utility companies must fulfill through solar energy. If utility companies do not purchase enough SRECs to meet these targets, they are subject to fines known as Alternative Compliance Payments (ACPs). The ACPs act as an incentive for utility companies to buy SRECs rather than paying fines. However, if the ACPs are set at a lower amount than the cost of an SREC, utility companies may choose to pay the fines instead, resulting in a decrease in demand and prices for SRECs.

To give you an idea of the potential financial benefits, let's consider a 10 kW residential system, which is the average size for a home. This system can generate approximately 12 SRECs per year. In states like New Jersey, where the prices of SRECs are high, this could mean an additional $2,484 in your pocket annually. However, in states with lower prices, the earnings from SRECs would likely range between $48 and $700 per year.

For the most up-to-date prices of SRECs, we recommend visiting SRECtrade, where you can find comprehensive information on the current market rates. The chart below lists the prices as of February 2025.

It's crucial to remember that the value of SRECs can vary over time due to shifts in supply and demand and changes in policy.

How are SRECs sold?

To sell your SRECs, you must register your system with the Public Service Commission and submit the registration to the Generation Attribute Tracking System (GATS). Once GATS approves your registration, your system will start generating credits. Thankfully, in most cases, your installation company will handle the registration process for you.

Once your system is registered and begins generating credits, you will need to decide on the best approach to sell these credits. You have the option of using a broker who will handle the sale to utility companies, or you can let your installer manage the sale for you. Both choices will come with a fee, typically a percentage of the total sale amount.

Paradise Energy will manage SRECs for you, whether we installed your solar panels or you used another installation company. All are welcome.

How Does Paradise Energy Handle Customer SRECs?

At Paradise Energy, we gather all our customers' credits to sell directly to a broker, relieving our customers of the hassle and ensuring they get the best possible price for their credits.

Our SERC management service comes at a cost of 6% of the sale amount for each credit, with a minimum charge of $4 per credit.

The frequency at which we sell SRECs we manage varies by state. In Ohio and Virginia, we conduct sales once annually, while in Pennsylvania, Maryland, and New Jersey, we have the opportunity to sell them twice a year.

We provide this service as an additional offering for all the systems we install, as well as for those who have a system installed by another provider.

Please be aware that income generated from the sale of SRECs is considered taxable income.