Protect your bottom line with solar

High electricity bills are eating into your profits and leaving your bottom line exposed.

By investing in solar, you can immediately cut a major expense and lock in significant, consistent savings, protecting your business from rising rates for the next 25+ years.

Don’t Let Your Energy Costs Control Your Business

Protect Your Bottom Line

A solar investment gives your business control and long-term certainty, protecting profits from the volatility of rising energy costs.

Save Money Immediately

Solar is a cost-saving investment that begins paying you back right away through lower electric bills, valuable tax incentives, and income from SRECs.

We Guarantee It

Paradise Energy’s Triple Ten Guarantee protects your investment. If your system falls short of our production estimate in the first ten years, we’ll send your business a check for the difference.

Hiring the wrong solar installer could cost you

No one wants to overpay for their system. But here’s the mistake we often see: people cut corners to save money upfront and end up paying more down the road.

- Poor Design & Subpar Workmanship

Cutting corners on design and installation leads to underperforming systems, higher maintenance costs, and missed ROI targets. - Weak Warranties

Standard manufacturer warranties alone won’t protect your investment. Without a production guarantee and an installer workmanship warranty, you risk unexpected costs if your system encounters issues. - Unreliability

Unreliable installers turn savings into losses, leaving your system unsupported and your business stuck with wasted time, costly repairs, and unnecessary frustrations.

Protect Your Solar Investment

With Paradise Energy, you get more than just a solar system. You gain a partner with a vested commitment to the long-term success of your investment.

- Strategic, site-specific design

Our experienced team will tailor your system to your needs, combining your goals with detailed site analysis and shade studies, providing an investment that truly protects your bottom line. - Guaranteed Savings

Our Triple Ten Guarantee protects your investment, covering workmanship, system monitoring, and guaranteed production to ensure your investment delivers on our promise to you – Long-term, predictable savings. - Reliable Long-term Partner

As a family-owned, debt-free company focused solely on solar, we’ve spent 16 years building lasting partnerships. Our in-house service team stands ready to support your system for decades.

See Why People Like You Choose Paradise Energy

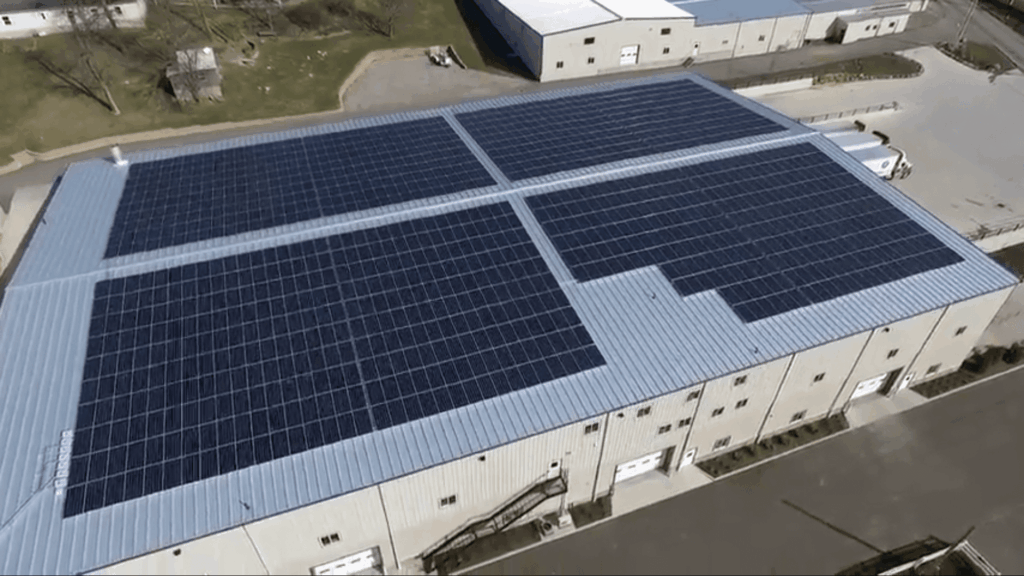

Our Commercial Solar Installations

Solar doesn’t have to be complicated.

Investing in solar can feel overwhelming, but it doesn’t have to be. We guide you through every step—before, during, and long after your system is energized. You will never be left in the dark. With clear communication and ongoing support, you’ll enjoy a seamless experience and a solar investment that delivers lasting returns.

Request Your Site Visit

Your local Solar Consultant will visit your site to understand your goals, gather key details, and answer your questions. Within 2–3 business days, you’ll have a detailed custom solar quote with all the critical information you need to make an informed investment decision.

Design, Permitting, and Installation

Once you choose to partner with us, we manage every step of the process, including: design, permitting, product procurement, grant writing, and construction. Depending on your project’s size and scope, this can take several months to over a year. Don’t worry. We’ll keep you informed every step of the way.

Your Savings Begin

Now comes the best part. Your solar investment is producing power, lowering costs, and letting you Save With Every Sunrise.

Commercial Solar Cost Estimates

| AVERAGE ELECTRIC BILL | SOLAR SYSTEM SIZE | COST BEFORE INCENTIVES | FEDERAL TAX CREDIT | DEPRECIATION | COST AFTER INCENTIVES |

|---|---|---|---|---|---|

| $600 | 50 kW | $133,300 | $39,990 | $29,539 | $63,771 |

| $1,200 | 100 kW | $223,900 | $67,170 | $49,615 | $107,115 |

| $2,400 | 200 kW | $407,900 | $122,370 | $90,389 | $195,141 |

Frequently Asked Questions

Are there grants available for commercial solar?

Businesses can take advantage of some grants offered by local agencies and utility companies, with the USDA REAP grant being the most commonly available. This grant is specifically designed for qualifying rural businesses and can cover up to 25% of the installation costs.

Our team of consultants will be able to help you identify all available grants.

What are the tax benefits for commercial solar?

Solar offers great tax savings for businesses.

There is a federal tax credit of 30% for systems under 1 MW. These projects can also qualify for up to three 10% adders.

The tax credit is available for systems over 1 MW, but there are several stipulations to follow.

Businesses can also take advantage of accelerated depreciation. This allows you to take 60% of the cost basis in federal depreciation in year one. The remaining 40% follows the five-year MACRS schedule.

100% of the state depreciation follows the five-year MACRS schedule.

How much do commercial solar panels cost?

Solar energy solutions are as unique as the businesses they power. To accurately determine the cost of a commercial solar system, we need to understand your electricity consumption, panel placement, and other key data points. Your system will be custom-designed for your needs, goals, and budget.

For a ballpark estimate, most businesses will need a system that costs $150,000 or more before incentives.

Request your custom quote to get an accurate price for your business.

What are Solar Renewable Energy Credits (SRECs)?

Solar Renewable Energy Credits (SRECs) are a valuable perk that often goes unnoticed by those who are new to solar energy. For every 1,000 kilowatt-hours (kWh) of solar energy their system generates, owners receive 1 SREC. These credits can then be sold in the open market, providing a source of passive income that adds to the benefits of owning a solar energy system.

Visit our SREC blog to learn more and to see how much they are selling for.

What warranties are included with a solar system?

Solar panels come with a performance warranty that guarantees the efficiency will stay above a specified percent. These warranties range from 25 to 30 years, depending on the brand.

Solar panels also come with a product warranty. These range from 12 to 25 years in length.

Inverters come with a warranty of 12 to 25 years depending on the brand and type.

In addition to manufacturer warranties, Paradise Energy provides an added layer of security with our Triple Ten Guarantee. This guarantees the production of the system for the first 10 years. It also covers workmanship issues.

Visit our product warranties blog to learn more.

Explore Our Solar Energy Resources and Tools

Estimate Your Installation Cost, ROI and Savings

Wondering what solar really costs and how quickly it pays back? Our free Price Estimator tool gives you instant answers. In just a few clicks, you’ll see a ballpark system cost, estimated savings, ROI, and payback period. No salesperson required.