Investing in commercial solar panels is more than just a step toward sustainability—it’s a strategic move to lower energy costs, reduce tax liabilities, and strengthen your business’s long-term financial health.

Yet, for most business leaders, the decision hinges on two key factors: the return on investment (ROI) and payback period.

So, the big question remains: is solar a smart financial move for your business in 2026?

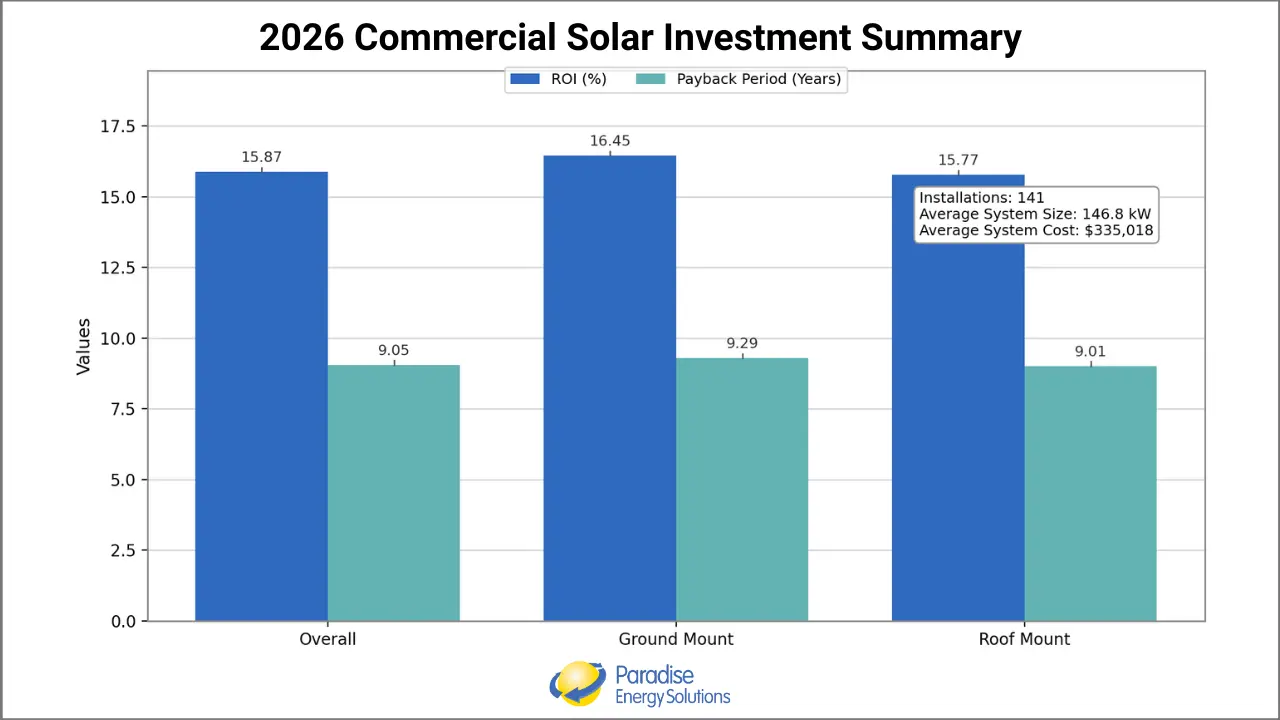

While solar isn’t a one-size-fits-all solution, we’ve analyzed data from over 141 agricultural and commercial solar energy systems installed by Paradise Energy in the last year to give you a clear picture of what to expect for commercial solar investment.

In this blog, we explore this data to provide you with a clear picture of what a solar panel investment could look like for your business and how you can maximize your solar investment in 2026.

Key Takeaways from our Commercial Solar Investment Data

Overall Performance:

- Average ROI for commercial solar installations: 15.87%

- Average Payback Period: 9.05 years

By Mounting Type:

Ground Mount Installations:

- ROI: 16.45%

- Payback Period: 9.29 years

Roof Mount Installations:

- ROI: 15.77%

- Payback Period: 9.01 years

State Highlights:

- Virginia had the highest average ROI: 21.05%

- Virginia had the shortest average payback period: 5.36 years

System Metrics:

- Average system size: 146.82 kW

- Average system cost: $335,018

Commercial Solar ROI & Payback in 2026

For this report, we grouped all our agricultural and commercial solar installations into a single category of over 140 installed solar energy systems. This report breaks down the results from all of those projects.

What’s The Average Return on Investment (ROI) for a Commercial Solar System?

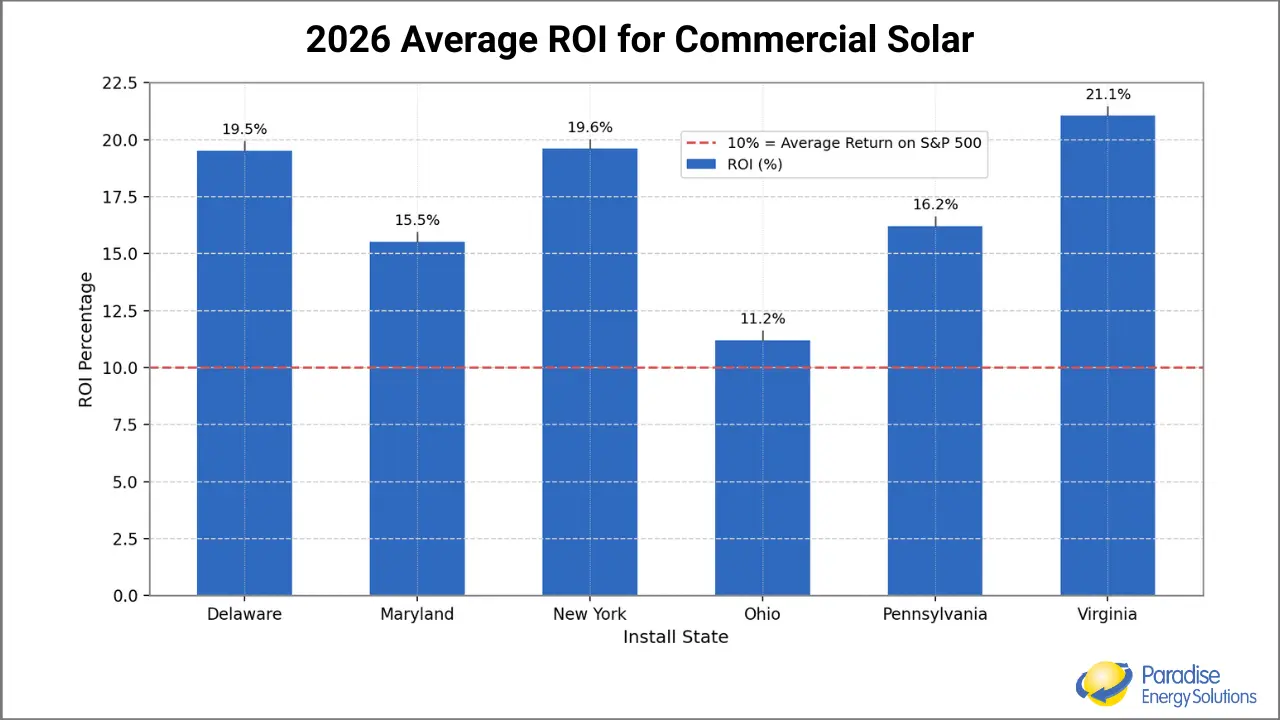

With an average ROI of 15.87%, Solar energy consistently outperforms traditional investments, such as S&P 500 stocks. While long-term stock investments generally yield around a 10% ROI, the data shows that business leaders can expect a higher annual return on a solar panel investment.

What makes solar an even better investment is its predictability. Solar ROI depends on two reliable factors: sunlight and your electricity needs, both of which are virtually guaranteed. In contrast, stock market returns rely on company performance and economic conditions, which can be unpredictable and volatile.

- Average ROI for commercial solar installations: 15.87%

- Average ROI for a commercial roof mounted solar installation: 15.77%

- Average ROI for a commercial ground mounted solar installation: 16.45%

What’s The Average Break-Even Point for Commercial Solar Panels?

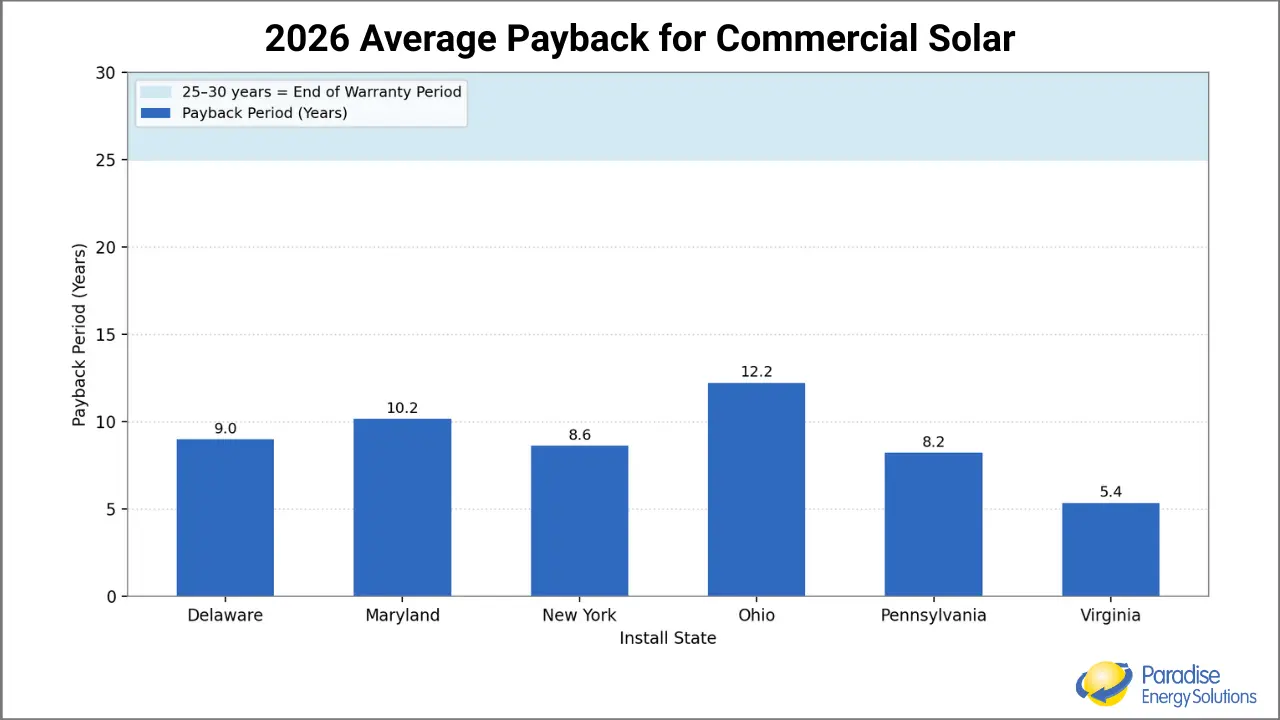

The average payback period for commercial solar panels is 9.05 years with an average system lifespan of over 30 years.

One of the most attractive aspects of solar investments is how quickly they start to pay off. You’re combining the elimination of an expense with the federal tax credit (expiring soon!) and accelerated depreciation to deliver a front-loaded financial return, often returning over 50% within the first year or two.

After the initial payback period, your electricity cost savings flow directly to your bottom line. Unlike utility bills, which never end, your solar system’s cost is finite. Once it’s paid off, you’re replacing an uncontrolled expense with guaranteed savings.

- Average payback period for commercial solar installations: 9.05 years

- Average payback period for a commercial roof mounted solar installation: 9.01 years

- Average payback period for a commercial ground mounted solar installation: 9.29 years

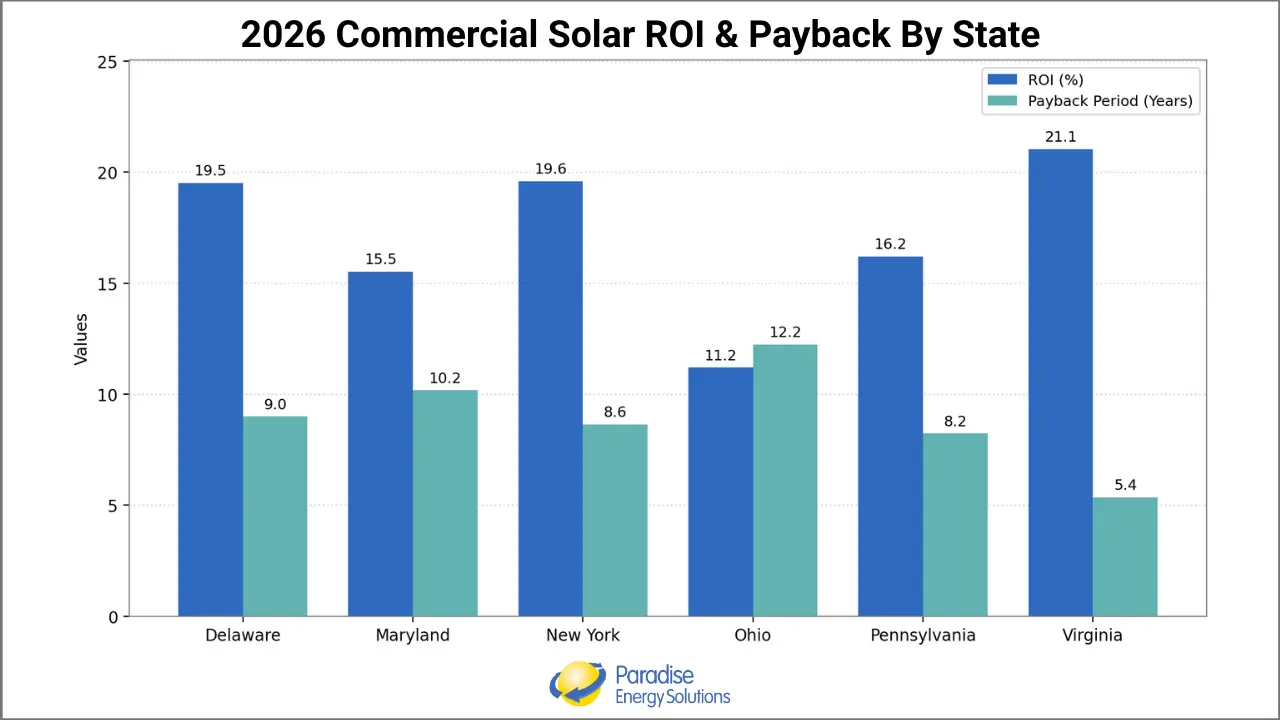

Commercial Solar ROI & Payback By State

Although Paradise Energy Solutions currently provides commercial solar installations and maintenance services in eight states, most of our agricultural and commercial installations in the past year were in six states.

We’ve compiled our data from six states to provide a breakdown of average system size, cost, ROI, and break-even point.

Commercial solar panel performance varies by state, with Virginia leading with an average ROI of 21.05% and the shortest payback period of 5.36 years. Ohio ranks at the bottom of our list, with an average ROI of 11.20% and a payback period of 12.24 years.

Delaware’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 196.79 kW

- Average System Gross Cost: $382,494

- Average ROI: 19.52%

- Average Payback: 9.00 years

Maryland’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 110.09 kW

- Average System Gross Cost: $288,100

- Average ROI: 15.53%

- Average Payback: 10.18 years

New York’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 206.29 kW

- Average System Gross Cost: $449,108

- Average ROI: 19.60%

- Average Payback: 8.64 years

Ohio’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 112.06 kW

- Average System Gross Cost: $289,407

- Average ROI: 11.20%

- Average Payback: 12.24 years

Pennsylvania’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 155.18 kW

- Average System Gross Cost: $351,049

- Average ROI: 16.21%

- Average Payback: 8.23 years

Virginia’s Commercial Solar Panel ROI & Payback Length

- Average System Size: 148.14 kW

- Average System Gross Cost: $283,764

- Average ROI: 21.05%

- Average Payback: 5.36 years

Common Questions About A Commercial Solar Investment

What incentives or tax benefits are available to improve the ROI of commercial solar?

There are several incentives and tax benefits that can significantly improve the ROI of commercial solar panels. Commercial solar systems under 1 MW AC qualify for a federal tax credit of 30% or more, depending on eligibility for additional 10% “adders” such as energy community or domestic content bonuses.

However, the tax credit expires in 2027, so it is critical to secure safe-harbor status for your investment by July 3, 2026, to allow sufficient time (up to four years) to install your system before the 2027 deadline.

Another great benefit of solar for businesses is bonus depreciation. Current rules allow 100% of the federal depreciation to be used in the year your system is energized. The state depreciation savings follow the five-year MACRS schedule.

Beyond tax incentives, the USDA REAP Grant and various local grant programs are available to help offset the upfront installation costs. Contact our team to learn what incentives are available in your local area.

How do maintenance costs affect the ROI of a solar panel system?

If properly installed, a solar panel system requires minimal maintenance. In most cases, the component that will require attention is the inverter. The good news is that both solar panels and inverters come with extensive warranties of 15, 25, or even 30 years.

At Paradise Energy, we go even further by offering our Triple Ten Guarantee, which covers most maintenance and warranty-related work, reducing potential out-of-pocket expenses for our customers during the first ten years.

These are some additional maintenance costs to consider:

- Solar panel cleaning: This may be necessary in dusty environments to maintain peak efficiency.

- Panel removal and reinstallation may be required for roof repairs or replacement. This service costs approximately $275- $300 per panel. We recommend installing solar panels only if your roof’s remaining lifespan is expected to exceed your solar system’s payback period. Otherwise, it may be best to install a new roof first.

How does a solar investment compare to purchasing machinery or other equipment?

Both solar investments and new machinery have distinct benefits, but they serve different purposes within a business. Here’s a comparison of the two:

- Solar reduces expenses: Solar lowers electricity costs and protects against rising energy rates, making it a cost-saving mechanism. In contrast, machinery increases operational costs, including electricity, maintenance, and wages.

- Machinery boosts production: Purchasing new machinery can increase production capacity and improve efficiency to help drive revenue growth, something solar does not.

- Long lifespan with minimal maintenance: Solar systems are designed to last 30+ years with minimal upkeep, whereas machinery typically requires regular maintenance and repairs, resulting in downtime and lost revenue.

- Tax benefits: Solar offers unique financial incentives, such as the federal solar tax credit and accelerated depreciation, while machinery may only provide standard depreciation benefits and business expense deductions.

- Return on investment: Solar delivers a front-loaded ROI, meaning most financial benefits are realized early in the investment. Machinery, on the other hand, often provides a steady, flat-line return tied to increased production.

While solar primarily focuses on reducing costs, new machinery can drive business growth by enhancing efficiency and production capabilities. Prioritizing a solar investment allows you to leverage its front-loaded returns, such as significant tax savings and energy cost reductions in the initial years, to open up significant capital to support other capital expenditures, like purchasing machinery.

By first capitalizing on solar’s quick financial returns, you can strategically invest in both solar and operational expansion rather than investing in one or the other. Use your solar savings to fund other capital expenditures.

What are the risks that could impact your solar ROI or payback?

There are several risks that could impact the ROI and payback of your solar investment, including:

- Net metering changes: If net metering policies are discontinued or changed, the value of the energy your system produces could decrease significantly.

- Dramatic electricity rate drops: Lower utility rates would reduce the cost savings from solar, potentially extending the payback period.

- Installer going out of business: If your installation company shuts down, it could affect warranty coverage and access to ongoing support.

- Equipment manufacturer goes under: If one of your equipment manufacturers closes their doors, it will impact your warranty coverage.

- Loss of the SREC market: If the Solar Renewable Energy Credit (SREC) market is discontinued or the value of a credit diminishes, you could lose an additional revenue stream that contributes to your system’s ROI.

- Maintenance Issues: Although maintenance concerns are minimal and the solar equipment comes with solid, long-term warranties, there is a risk of inverter failure or other system components being damaged. This could impact the system’s production capabilities (most likely in the short term) and create additional expense to diagnose and resolve the issue(s).

Discover Your Solar Investment ROI and Payback

Are you interested in seeing how solar energy could improve your business’s bottom line? The first step is to talk with one of our local solar consultants. Your solar consultant will help you make an informed decision by answering your questions, reviewing your site’s solar feasibility, and providing a detailed quote.

If you are not yet ready to talk with a solar consultant, no problem. We have tools to help you continue investigating solar on your own. Use our solar payback calculator or visit our solar learning center to keep on learning.