A commercial solar panel system provides businesses with numerous tangible financial benefits. By investing in solar, your business can control a fixed cost, reduce tax liability, and realize long-term, consistent savings.

However, the window of opportunity for businesses to capitalize on the solar investment tax credit is closing. The Big Beautiful Bill is ending this long-standing benefit.

We’re here to unravel the intricacies and help you understand how your business can benefit from the tax savings solar provides before the window of opportunity closes.

What Tax Benefits Are Available For Commercial Solar Panels?

There are two main tax benefits for commercial solar:

- the federal solar investment tax credit (ITC), and

- accelerated depreciation

Each offers significant tax savings for your business.

How Does The Federal Tax Credit Work for Commercial Solar?

The Federal Solar Investment Tax Credit (ITC) is a tax credit granted by the US federal government that businesses can use to offset their federal tax liability. Businesses can recoup 30% or more of the cost of the solar system installation.

However, the passing of the Big Beautiful Bill and the “Ending Market Distorting Subsidies for Unreliable, Foreign Controlled Energy Sources” executive order that followed are bringing the commercial solar tax credit to an end.

Here’s what you need to know:

- The full tax credit is available until the end of 2027.

- Foreign Entities of Concern (FEOC) requirements now apply to all commercial solar projects. To qualify for tax credits under Sections 45Y or 48E, at least 40% of the value of manufactured products used in a solar project must come from manufacturers that are not classified as prohibited foreign entities, including China, Iran, Russia, and North Korea. While these requirements are now in effect, the federal government has not yet released full guidance on how they will be defined, verified, or enforced.

- Commercial solar projects must be safe harbored by July 3, 2026, to preserve eligibility and extend the installation window by up to four years. Projects that are not safe harbored must be fully installed by December 31, 202,7 to qualify for the federal tax credit.

- For projects 1.5 MW AC and smaller, safe harboring (start of construction) means either beginning physical work or “safe harboring” by spending 5% of your project costs, typically through the purchase of equipment. Paradise Energy recommends a 7% upfront investment to help safeguard your project against future price increases that could otherwise reduce your safe harbor amount below the required 5% threshold.

- Projects larger than 1.5 MW AC may no longer qualify for the safe harbor. They must begin physical work to qualify.

Once safe-harborred, you’ll have until December 31, 2030, to complete the installation and still claim the credit.

How Much Is The Commercial Solar Tax Credit?

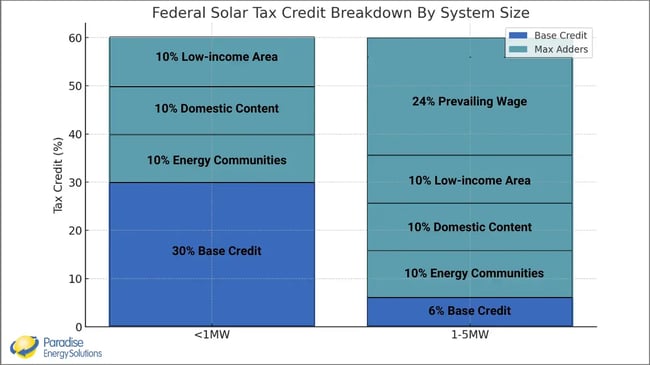

Commercial Solar Systems Under 1 MW AC Power

Systems under 1 megawatt (MW) AC power will receive a tax credit of at least 30% of installation costs. For most businesses, this is the guaranteed rate until 2025.

In addition to the 30% credit, you could qualify for one or more 10% adders:

- Energy communities (+10%): This aims to encourage the adoption of solar on some brownfield sites and in some communities with fossil-fuel-focused economies. Use this map to see where they are.

- Domestic content (+10%): To bolster American-made solar components, using domestic materials and equipment can save you more.

- Low-income areas (+10%): Businesses in areas that meet low-income qualifications can receive an additional 10% of the tax credit.

Commercial Solar Systems 1 – 5 MW AC Power

The tax credit for solar systems with 1 to 5 MW AC power starts at 6%. If the project meets certain conditions, the tax credit can increase to 70%. These conditions include:

- Prevailing wage (+24%): You can gain the 30% credit if the project meets apprenticeship and prevailing wage requirements.

- Energy communities (10%): Same as above

- Domestic content (10%): Same as above

- Low-income area (10%): Same as above

Larger systems have a second option. Instead of the ITC, you can choose a production tax credit (PTC). With this, you’ll earn credit for each kilowatt-hour (kWh) of electricity your system produces.

What Happens If My Business Doesn’t Owe Enough Taxes to Use the Full Credit?

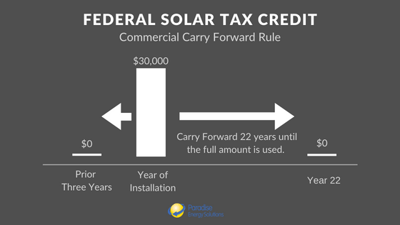

The federal solar tax credit offers flexibility; you are not required to claim it in the same year your system becomes operational. Businesses have an extended window to utilize the Investment Tax Credit (ITC) fully. The credit can be carried backward for three years and forward for up to 22 years.

The federal solar tax credit offers flexibility; you are not required to claim it in the same year your system becomes operational. Businesses have an extended window to utilize the Investment Tax Credit (ITC) fully. The credit can be carried backward for three years and forward for up to 22 years.

Here’s how it works: The tax credit is initially applied in the year your system is placed into service. If your business does not owe enough in taxes to utilize the full credit that year, you can carry it back to offset taxes paid during the previous three years or carry it forward for up to 22 years.

For instance, if your system is placed into service in 2026, you can apply the credit to taxes owed for any year between 2023 and 2048. This flexibility ensures you can strategically maximize the tax benefits when they align best with your business’s financial needs.

The three-year carryback is authorized under IRC § 39(a)(4), which expands the normal carryback rule in § 39(a)(1) for applicable clean-energy credits, including the solar ITC under section 48.

What Are the Rules for Recapture, and How Long Do I Need to Keep the System in Use?

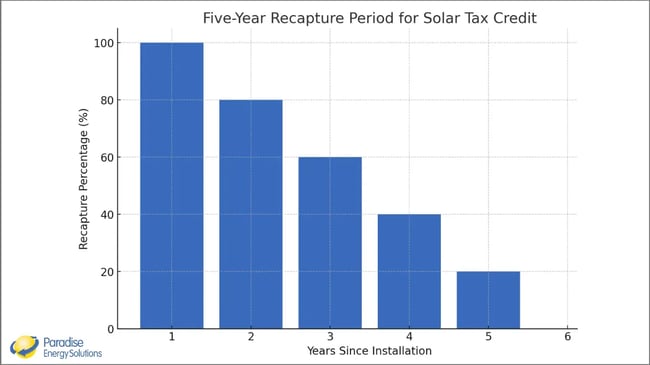

The commercial solar tax credit comes with recapture rules, which means you may have to pay back a portion of the credit if your solar system is sold, destroyed, or stops being used in a qualifying way within five years.

It should also be noted that if the system will partially be used for personal use (for example, a system on a farm that supplies enough electricity for both the farm and the farmhouse), the farmhouse portion would not be eligible for depreciation and the credit would be under Section 25D (the Residential Energy Credit). It is best to keep your business and personal uses separate for five years.

How The Recapture Rules Work:

-

The five-year recapture period begins the year your solar system is placed into service.

-

In the first year, 100% of the credit is subject to recapture. The recapture percentage decreases by 20% each year, dropping to zero after year five.

-

If the property no longer qualifies during this period, you’ll owe taxes on the unvested portion of the credit in the year the recapture is triggered.

What Can Trigger a Recapture Event?

-

The solar system is no longer used as a qualified energy facility, or it is partially qualified for business use and partially residential use.

-

The system is permanently destroyed and not repaired or replaced.

-

Ownership of the system changes hands during the recapture period.

If any of these events occur, the IRS will recapture the unvested portion of your solar tax credit, leading to an increased tax bill.

How Do You Apply For The Federal Solar Tax Credit?

Step 1: Consult with a Tax Professional

Work with a CPA before installing solar to ensure you understand the tax implications and your eligibility/ability for your business to use the tax credit and depreciation.

Step 2: Gather Documentation

- Copies of purchase and installation invoices.

- If the bonus adders are being claimed, proof of eligibility should be provided.

- Evidence of solar system use (e.g., utility bills or operational data).

Step 3: File IRS Form 3468

For businesses, the solar tax credit is claimed on your business tax return using IRS Form 3468. The individual partner/shareholder then files Form 3468 (a duplicate of the business’s filing, reporting their share) and Form 3800.

How Does Depreciation Work for Commercial Solar Panels?

While the Big Beautiful Bill ends the tax credit, it reinstates 100% accelerated bonus depreciation for commercial solar, which applies only to federal depreciation.

The system cost is reduced by half of the tax credit. That means if your tax credit is 30%, the depreciable basis would be 85% of the total cost (100% – [30% x .5]). So, if your system costs $100,000 to install, you’d depreciate $85,000.

Here’s how it works for 2026:

- You can take 100% of the solar system’s entire federal depreciation in year one.

- Your state depreciation will follow the five-year MACRS schedule

If you opt for the production tax credit (PTC) over the ITC, your depreciable basis will not be reduced. You can depreciate 100% of the system’s cost, not just 85%. However, the PTC typically only makes sense for large, utility-scale systems.

Commercial Solar Tax Incentives: Frequently Asked Questions

How Do Solar Tax Benefits Differ from Other Business Investments?

The key difference between tax incentives for commercial solar systems and other business investments is that the tax benefits are heavily front-loaded. With solar, a significant portion of the tax credit and accelerated depreciation can be realized within the first few years after your system is energized, providing an immediate boost to your cash flow and reducing the payback period.

How does installing solar impact my business’s tax liability in the long term?

The federal solar tax credit gives you the flexibility to offset taxes not only in the year your system is energized but also retroactively for the prior three years of carried forward for up to 22 years. This adaptability allows you to maximize the credit when it provides the greatest benefit to your business.

Combined with accelerated depreciation through MACRS, which spreads additional tax savings over several years, solar provides a long-term financial advantage while reducing your energy expenses and enhancing cash flow.

What are the upfront costs vs. long-term savings with solar tax incentives?

The upfront installation costs of a commercial solar system can vary widely based on system size, location, and project complexity, but tax incentives significantly reduce the initial cost. The federal tax credit allows you to recoup 30% or more of the installation cost starting in year one. Additionally, accelerated depreciation enables you to recover another substantial portion of the cost over the first five years.

There are also several grant opportunities available to help reduce your solar installation costs, including the USDA REAP Grant, as well as grants from local utility companies and state governments. To find out what incentives are available in your area, consult with your local solar experts for the most up-to-date options. Long-term savings come from reduced energy bills and protection against rising utility rates. Combined with the immediate savings, these savings typically result in a payback period of less than 10 years—and decades of financial returns. By leveraging both tax incentives and energy cost reductions, solar can deliver significant ROI and long-term financial stability for your business.

Do solar incentives vary by state, and how do I find what’s available in my area?

Yes, solar incentives can vary by state, as some states and utility companies offer additional grants, rebates, and different net metering rules. However, core benefits like the federal Investment Tax Credit (ITC) and accelerated depreciation apply to businesses nationwide.

Use our state-by-state guide to solar incentives to see which incentives are available in your state.

Can My Business Claim The Solar Tax Incentives if the Solar Panels are Leased?

No, the solar tax credit and depreciation benefits are exclusively available to the system owner. For a leased system, this means the lessor – not the lessee – is eligible to claim these benefits.

How Can Solar Improve The Future of Your Business?

Solar is a long-term, cost-reducing investment with significant tax savings and an immediate impact on your bottom line. If you want to learn how your business can benefit from a solar panel investment, connect with our team of local solar experts. They are ready to answer your questions and help you navigate this business investment opportunity.

If you’re not ready to speak with our team, no problem! We have tools for you to continue investigating solar on your own. Use our solar payback calculator to get an instant estimate of what solar could look like for your business. Then, visit our solar learning center for answers to common questions asked by other business leaders.